BTC Faces Fresh Decline Predictions as Cryptocurrency Market Sees $200M+ in Liquidations

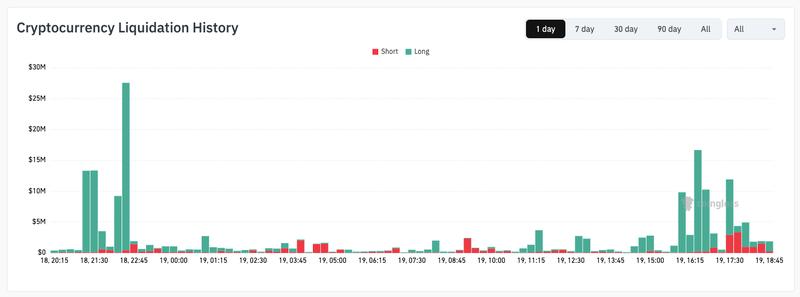

Cryptocurrency traders experienced over $200 million in daily liquidations while Bitcoin's confined trading range contributed to intensifying bearish market sentiment.

On Thursday, Bitcoin (BTC) became the subject of renewed bearish forecasts as the cryptocurrency's price movements maintained elevated levels of long position liquidations.

Key points:

- Technical analysis of Bitcoin's price trajectory suggests additional downside ahead due to the absence of a robust recovery.

- Significant liquidation volumes stand in stark contrast to Bitcoin's confined price movement patterns.

- Investment funds in the cryptocurrency sector record their fourth consecutive week of capital withdrawals amid severely pessimistic sentiment.

Market Observer Anticipates Bitcoin Will "Test Lower" Levels

According to information from TradingView, the BTC/USD trading pair remained confined within an increasingly compressed range throughout the session, reaching daily lows at the $65,620 mark.

Despite a slight uptick in US unemployment claims data released ahead of the stock market opening, market sentiment remained largely unchanged, with traders anticipating that lower price levels would soon emerge as focal points.

Michaël van de Poppe, a cryptocurrency trader, analyst and entrepreneur, shared his observations regarding the four-hour chart in a social media post on X, stating, "This looks to me as if we're going to test lower on the markets to see whether there's some support on Bitcoin."

"Not a strong bounce, and constant lower highs."

Meanwhile, CryptoReviewing, the pseudonymous cofounder behind the trading community known as Wealth Capital, highlighted the continued presence of substantial liquidation figures even as Bitcoin price movements exhibited relatively limited volatility.

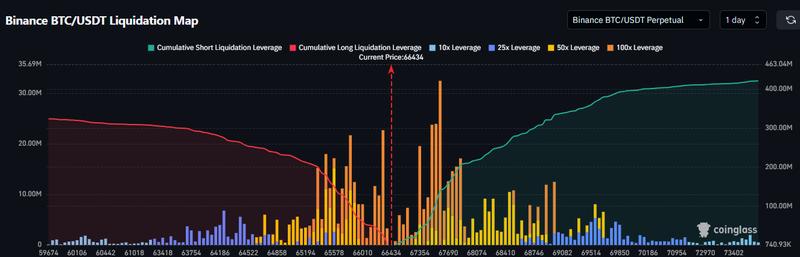

Sharing data sourced from CoinGlass with his X audience, he noted, "Now, below us at $64,000 - $66,000 we still have a sizable amount of liquidity."

"However, $68,000 - $71,000 has around 3x more liquidations built up ready to be taken, making this a higher probability zone to visit in the next days. Bulls really need to respond soon."

At the time of reporting, CoinGlass recorded total liquidations across the cryptocurrency market at $210 million over a 24-hour period.

Nevertheless, trader Daan Crypto Trades characterized the liquidity levels in the immediate vicinity as "nothing major."

He provided this summary: "This current ~$66K area has held as support for the past 2 weeks with ~$71K capping price. Will see if we get a decisive break by the end of the week because as of now there's not much action going on."

Major Investors Highlight "Extreme Bearish Levels" in Markets

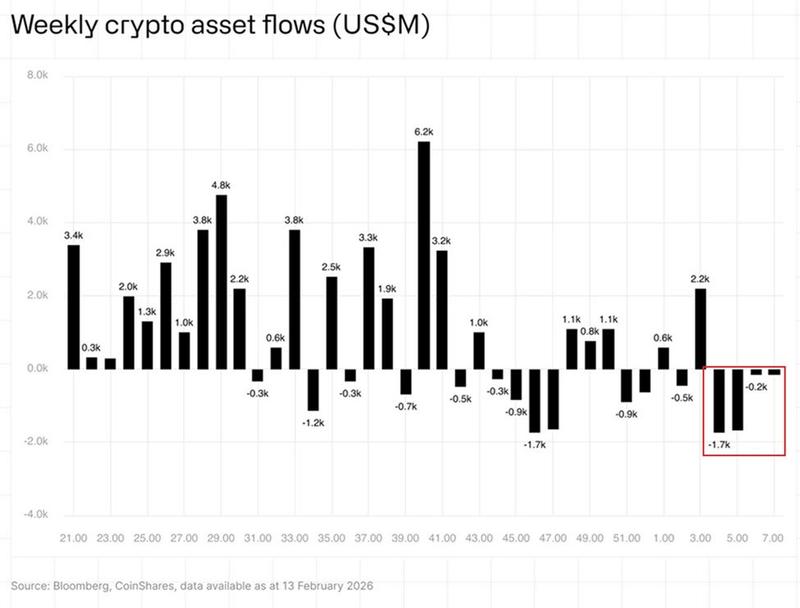

The exodus of institutional capital from cryptocurrency investment vehicles, in the meantime, drew notice from mainstream market observer The Kobeissi Letter.

Through a post published on X during the trading day, Kobeissi drew attention to the previous week's outflows totaling $173 million from cryptocurrency investment funds, marking their fourth straight week of negative performance.

The analysis elaborated: "This brings 4-week cumulative outflows to -$3.74 billion. Bitcoin led the selling with -$133 million in outflows last week, while Ethereum saw -$85 million. Crypto funds have now seen withdrawals in 11 out of the last 16 weeks."

According to previous coverage by Cointelegraph, the spot Bitcoin exchange-traded funds (ETFs) operating in the United States represent one component of the institutional marketplace facing sustained headwinds under prevailing market circumstances.

The Kobeissi Letter characterized current market sentiment as "reaching extreme bearish levels."